In recent years we’ve seen many finance and investment apps catching people’s attention. The Stash app is now one of the main players in the game.

This Stash app review will highlight it’s major pros and cons, and answer the most important question: Is Stash app a scam?

What is the Stash App?

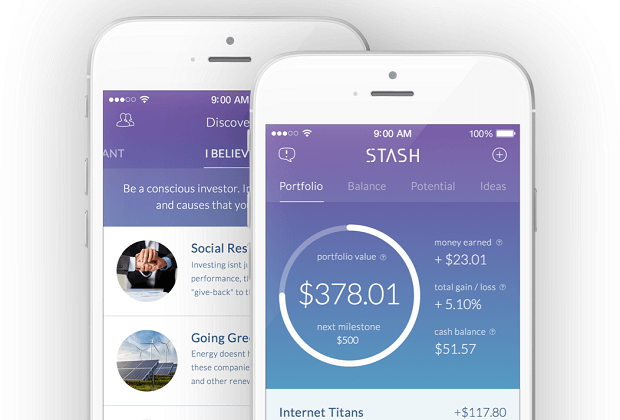

The Stash app allows you to automatically deposit funds from your checking or savings account into to an investing account. You can then invest in various industries without paying a trading fee.

While there is no trading fees, you will need to pay additional fees for using the Stash app.

Bottom line: The Stash app was designed to help make investing easy and approachable for beginners.

If you are new to investing, be sure to check out our additional articles on investing

You can also download the Stash App here.

How to get started with Stash App

First, go to Appstore or Playstore to get your Stash app.

Next, create your account.

You will need to feed in your basic credentials like name, email, etc.

It will then ask you ‘What type of investor do you see yourself as?’

The three options you have are:

- Conservative: You don’t want to take a lot of risks and prefer stability over greater gains.

- Moderate: Some risks are okay for you. You are willing to take modest losses for modest gains.

- Aggressive: You can take large market swings for bigger gains in the long run.

What option you chose depends upon how close you are to your retirement.

If you have longer plans like retiring at or around 65, then you can go for aggressive. But if you want to stay stable and are already semi-retired, go for conservative, so you have a little less damage/surprises coming your way.

It then asks you for your status.

Are you employed, unemployed, student or retired?

The next question in the queue is, ‘How much will you make this year?’ and ‘What is your approximate net worth?’

There are a series of personal security questions that also follow.

There will come a point in the process when you actually start to wonder… how much does this app need to know about you.

Is Stash app a Scam?

Let’s dig deeper to find out if the Stash app is a scam or not.

How does Stash app work?

Once you are all set with the initial login and security checks you are set to start stashing for your investments.

For this purpose, you will have to link your bank account with the app and let it know how much you want to save every week.

For instance, you could say you want to transfer $25 every week to your investment account.

Once the credit reaches your investing account you can check out where to invest from within the application. There are plenty of options on the table for you.

The Stash app has very interesting categories for investment options, like:

- I believe (companies you believe will return well on investment)

- I want (companies you want to invest in)

- I like (companies you or other people like to invest in)

- Companies (other various companies)

Copy the Experts

There is an option for you to ‘Copy the Experts’ for the index funds in the Stash app. This option provides an interesting mix of companies to choose from.

You will have to dig a bit deeper to see who they are trying to follow and whether it is worth it for you to follow them or not.

When you buy any shares it will wait for the next trading window to buy them for you. Until then your investments are pending inside the app.

You can even buy fractions of a share without paying the trading fees.

Normally when you buy any share you have to pay something like $7.99 and $9.99 for one single trade.

What are the Stash app Fees?

There are no fees during the first month for using the Stash app. It’s like having a free stash app trial month, you can say.

However, there is a $1/month subscription on accounts under $5,000 portfolio value. That translates to around $12/year.

If you have something very small to invest, like $120, you are essentially paying a good 10% in fees.

As you increase your portfolio value, the effective percentage of fees that you pay will start to go down.

If you look at the S&P 500, the historical average return over a really long period of time is about 8%. Let’s say you make that 8% average, you need to keep at least $150 in there to break even on paying the fees.

Of course, you don’t want to let the fees eat up all your gains. For that, you will have to keep something above $150 in your account. Just for reference, at $1,000 your fee is roughly 1.2%. Although it’s still pretty high, for a small portfolio account, this seems to be better in the long run.

The percentage fee goes down until you hit $5,000. By the time you hit $10,000, your percentage fee is 0.24%.

After the $5,000 mark, you no longer have to pay the monthly fee. It is now a percentage of your total portfolio value. From then on, the more you put in the more you have to pay.

It could mean a $240 fee on your portfolio funds of $10,000, which is quite high.

Also, if you are investing in some sort of mutual funds you will have to pay double fees.

Hence, the Stash app is not recommended for any sizable portfolio balance.

Let’s say if you reach $50,000 just move all your money to a traditional type of investment account where you can actually get a certain number of free trades.

So, the big question, is Stash app a scam?

Is Stash app a scam?

Well, there is a smarter way of using the app. It is recommended for anyone who is just starting out in investing and has some assets of around $1,000 to $10,000 to invest.

If you have anything beyond that, you should avoid the heavy Stash app fees and go for the traditional investor account.

Stash app is also legit and good for people who want to buy fractional shares. People who wish to buy a little of this and a little of that.

Fun Fact: Within the Stash app, they invest in IVV which itself is charging 0.04%. If you use the app to do it you will be paying a 0.29% in fees which is a dumb way to do it.

If you buy this S&P 500 ETF fund on your own you would have more money left over after fees.

When you cross your $50,000 mark, get your money out and invest directly in the S&P funds.

So, use the Stash app to buy fractional shares, contribute to certain funds, and learn a bit along the way. The app itself wants to teach you a bit about investing. But if you want to go big, avoid the fees and go traditional.

Hopefully, this Stash App review was helpful for you. No we don’t think Stash app is a scam, but we do suggest you avoid the unnecessary fees. If you want to learn more about great apps to help you make additional income online. Be sure to check out our free online training center.

Inside we share more great ideas to help you make money online. Check it out by clicking on the link ==> https://WiFiEntrepreneur.com/Training-Center