Imagine you have the opportunity to buy more of your favorite stocks, cryptocurrencies, or forex pairs without needing a huge amount of upfront cash. Margin trading offers this exciting possibility, allowing traders to amplify their purchasing power.

This article explores the intricacies of margin trading, highlighting its potential to make more money, whether you’re a beginner or an experienced trader.

We’ll also introduce you to our AI trading indicator, which can help you make consistent, profitable trades and automate your crypto trading.

Understanding Margin Trading: Building a Strong Foundation

What is Margin Trading?

Margin trading involves borrowing funds from a broker to trade financial assets. This allows traders to open larger positions than they could with their own capital alone. It’s like using a lever to lift something heavy; margin trading provides the leverage to increase your trading capacity.

How Does Margin Trading Work?

When you trade on margin, you deposit a fraction of the total trade value, known as the margin, and borrow the rest from your broker. For example, if you want to buy $10,000 worth of stock but only have $2,000, you can borrow the remaining $8,000. Your $2,000 acts as collateral.

Key Terms in Margin Trading

- Leverage: The ratio of the borrowed funds to your own capital. A 5:1 leverage means you can trade five times the amount of your capital.

- Margin Call: A demand from your broker to deposit more funds if your account value falls below the required margin.

- Maintenance Margin: The minimum amount of equity you must maintain in your account to keep your positions open.

Risks and Rewards of Margin Trading

The Rewards

- Increased Buying Power: Amplifies your potential profits by allowing you to control larger positions.

- Diversification: Enables you to invest in a broader range of assets.

The Risks

- Higher Loss Potential: Just as profits can be magnified, so can losses. You might lose more than your initial investment.

- Margin Calls: If your positions lose value, you may need to deposit more funds or sell assets at a loss to meet margin requirements.

Advanced Margin Trading Strategies: Elevate Your Trading Game

Short Selling: Profiting from Declines

Short selling involves selling assets you don’t own, hoping to buy them back at a lower price. This strategy is commonly used in margin trading. For example, if you believe a stock will decrease in value, you can borrow shares to sell now and repurchase later at a lower price, pocketing the difference.

Using Stop-Loss Orders

A stop-loss order automatically sells a position when it reaches a certain price, limiting potential losses. This tool is crucial in margin trading to prevent significant financial damage.

Hedging with Margin Trading

Hedging involves opening a position to offset potential losses in another investment. For instance, if you have a long position in a stock, you can use margin to short sell the same stock or a related one to hedge against market downturns.

Margin Trading in Different Markets

Stocks

Margin trading in the stock market allows you to buy more shares than you could with your available funds. This can be especially advantageous during bullish markets.

Forex

The forex market often offers high leverage ratios, sometimes up to 100:1. This makes margin trading a popular choice among forex traders seeking substantial returns from currency fluctuations.

Cryptocurrencies

Cryptocurrency exchanges also offer margin trading, enabling traders to take larger positions in volatile markets. However, the high volatility of cryptocurrencies increases the risk.

Practical Tips and Best Practices for Margin Trading

Start Small and Gradually Increase Exposure

Begin with small positions to get comfortable with margin trading. As you gain experience and confidence, you can gradually increase your exposure.

Use AI Trading Indicators

Our AI trading indicator is perfect for beginners and experienced traders alike. It helps identify profitable trades and offers guidance on setting up and configuring bots to automate crypto trading.

Monitor Your Positions Regularly

Keep a close eye on your margin positions and be prepared to act quickly to avoid margin calls. Regular monitoring can help you stay ahead of market movements.

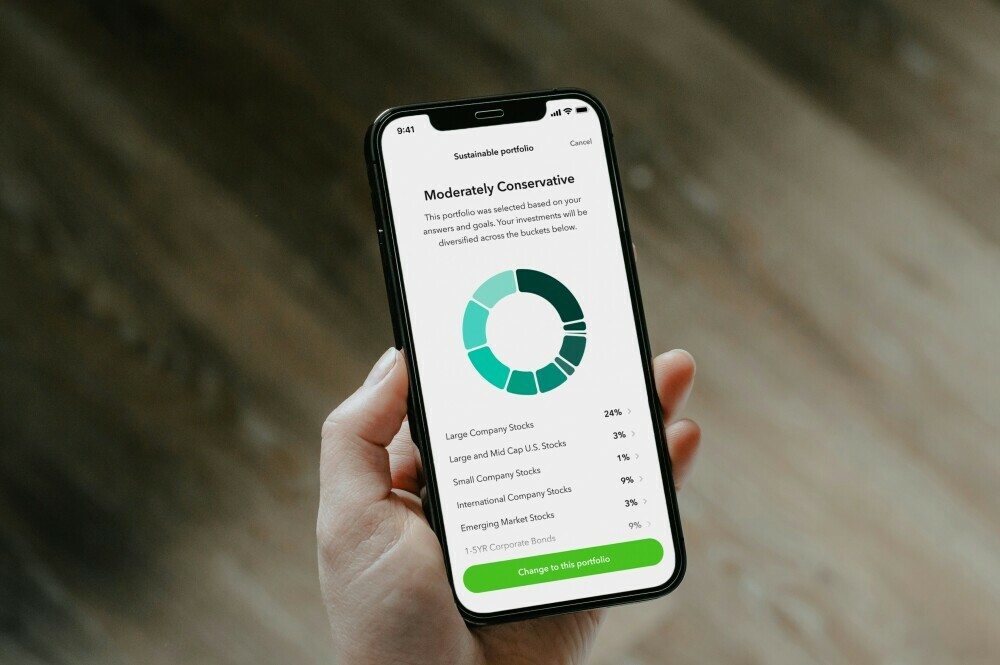

Diversify Your Portfolio

Avoid putting all your eggs in one basket. Diversify your investments to spread risk and increase the chances of profit.

Educate Yourself Continuously

The financial markets are constantly evolving. Stay updated with market trends, news, and trading strategies to make informed decisions.

FAQs: Common Questions About Margin Trading

What is the minimum margin requirement?

The minimum margin requirement varies by broker and asset. Typically, it ranges from 25% to 50%.

Can I lose more than my initial investment?

Yes, margin trading can result in losses exceeding your initial investment. It’s crucial to manage risk carefully.

How do margin calls work?

If your account equity falls below the maintenance margin, your broker will issue a margin call, requiring you to deposit more funds or sell assets.

Is margin trading suitable for beginners?

Margin trading carries significant risks and may not be suitable for everyone. Beginners should start with lower leverage and gain experience before increasing their exposure.

How can I avoid margin calls?

Regularly monitor your positions, use stop-loss orders, and avoid over-leveraging to minimize the risk of margin calls.

Pros and Cons of Margin Trading: Weighing the Benefits and Risks

Pros

- Amplified Profits: Potential for higher returns with less capital.

- Increased Market Exposure: Ability to invest in more assets.

- Flexibility: Opportunity to use various trading strategies.

Cons

- Higher Risk: Possibility of substantial losses.

- Margin Calls: Risk of having to deposit more funds.

- Interest Costs: Paying interest on borrowed funds.

Unlock the Potential of Margin Trading

Margin trading can be a powerful tool for traders looking to maximize their profits and diversify their portfolios. However, it’s essential to approach it with caution, understanding the risks and using strategies to mitigate them. By leveraging our AI trading indicator and following best practices, you can enhance your trading experience and achieve more consistent results.

Take Action: Start Your Margin Trading Journey Today!

Ready to explore the exciting world of margin trading? Sign up for our 14-day free trial and access our AI trading indicator at www.AITradingSignals.co. Join our free online training center at wifientrepreneur.com/training-center to learn how to set up and configure a bot for automated crypto trading. Elevate your trading game and start making smarter, more profitable trades today!